Realtor's Guide to Crushing Your 2023 Resolutions

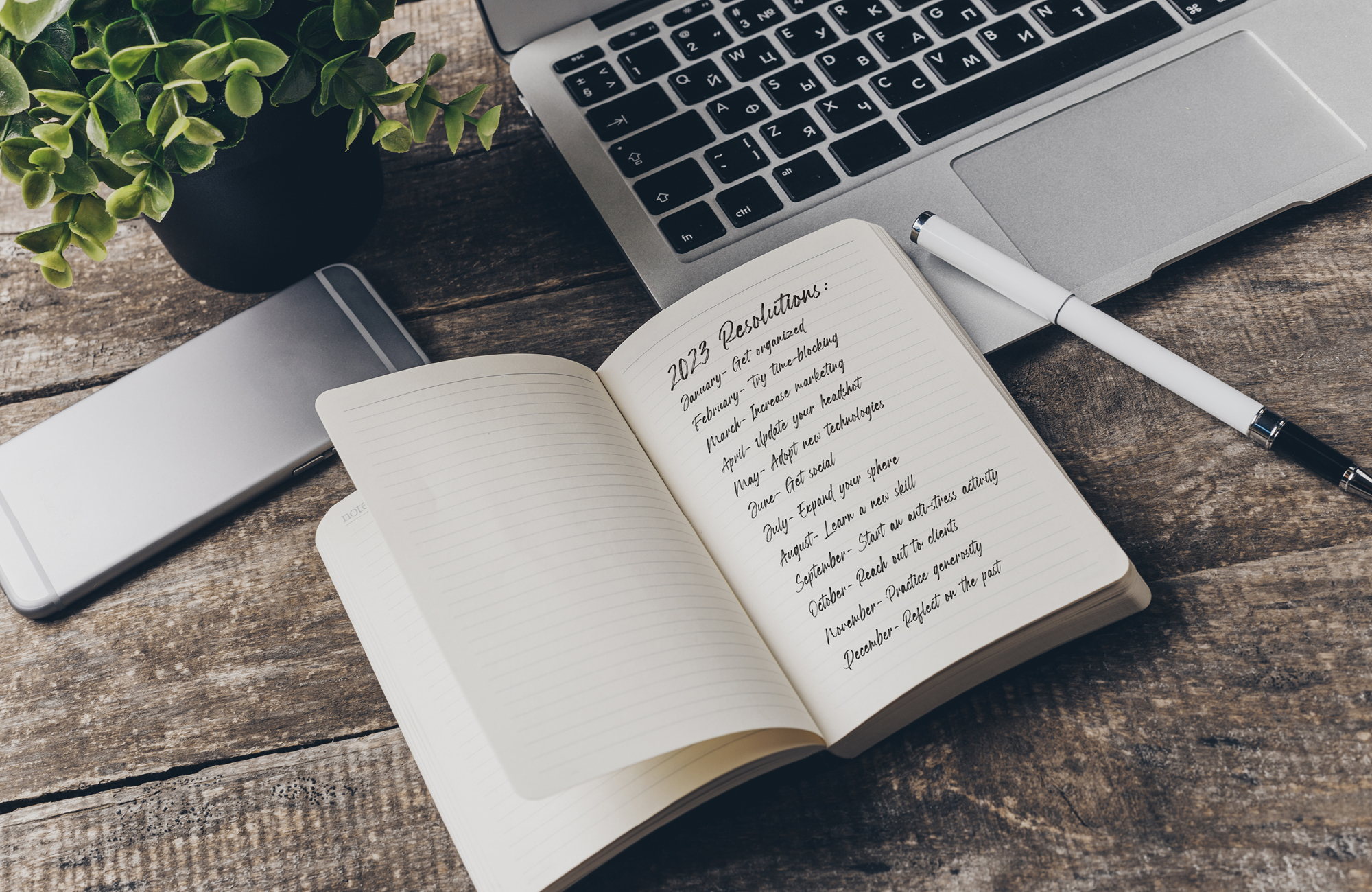

Instead of piling on the ambitions from the get-go, why not try this New Year’s Resolution Monthly Challenge? Try to develop one good habit per month for the entire year and see how it helps move your business forward!

January - Get organized: Take the time to organize files and documents in your office and at home. Digitize as much as possible. Don’t forget to clean up and organize documents and files on your computer as well. It’s a good idea to go through your CRM and organize and update your email lists with new information. Invest in a new 2023 agenda book and make a habit of writing all of your appointments and activities in your agenda book.

February - Try time-blocking: Work smarter, not harder. Schedule your key priorities early in the day, then fill in the rest of your time with other tasks. Avoid multi-tasking and focus on one thing at a time. Add your time-blocking schedule to your agenda book, and try color coordinating different tasks, from urgent to routine.

March - Increase marketing: Schedule a time to meet with your loan officer to discuss co-branded marketing opportunities, and create a specific plan based on your business. Whether you’re new to marketing, or you’re a pro, you should always be looking around for new or different opportunities to market to new prospects. We have a team of in-house marketing professionals who can help you design a marketing campaign to increase your prospects and get new clients in the door.

April - Update your headshot: If you haven’t updated your headshot in a few years, now might be the time. You are the face of your business, so take the time to get a professional headshot and update it on your website, social media sites and listing portals. It’s a worthwhile investment in your personal brand. Why? A good headshot conveys professionalism, your personality, and makes you look and feel your best.

May - Adopt new technologies: If you haven’t already, download our co-branded mobile app. The mobile app is a digital business card and powerful tool that allows clients to calculate payment scenarios, browse for homes and apply for a mortgage all on their phone. You can add your own custom links within your version of the app, such as your social media sites, websites and listings. Plus, with real-time loan status updates, you’ll always be up-to-date on the status of your client’s loan.

June - Get social: Increase brand awareness by posting consistently on a social media site of your choice, such as Facebook, Instagram or LinkedIn. Social media takes time and effort and should be a direct reflection of your personality and brand. If you’re not sure where to start, reach out to your loan officer and see if they can schedule a Social Media Lunch and Learn from our social media experts. What platforms should you have a presence on? How often should you post? What types of content should you post? How do you create a strategy that shows your personality, while still being professional and positioning yourself as an expert in your field?

July - Expand your networking group or work on maximizing your sphere: Remember, nobody builds a business alone! Get involved in a new networking group to help pass business back and forth. Networking groups also serve as a great way to learn new ideas to improve your business or find new vendors or suppliers. You’ll get great advice and also gain some comradery from people who share your same hopes and aspirations.

August - Learn a new skill: Ask your loan officer to host a Lunch and Learn about a mortgage product that you want to learn more about. It’s always a good idea to be knowledgeable on the mortgage products available to your clients!

September - Start an anti-stress activity: Take up a relaxing activity such as yoga, gardening, or meditation. Try practicing mindfulness in the morning or before bed at night. There are several mediation apps that can customize a meditation routine that best fits your lifestyle.

October - Reach out to clients, old and new: Treat potential or past clients with a pop-by gift. Remember, don’t let them forget about you! Here are a few ways that you can get in front of your sphere and make sure that your nurturing your relationship!

December - Reflect on the past: Reflect on your favorite resolutions from the year and plan to implement them in your daily, weekly, or monthly routine.

January - Get organized: Take the time to organize files and documents in your office and at home. Digitize as much as possible. Don’t forget to clean up and organize documents and files on your computer as well. It’s a good idea to go through your CRM and organize and update your email lists with new information. Invest in a new 2023 agenda book and make a habit of writing all of your appointments and activities in your agenda book.

February - Try time-blocking: Work smarter, not harder. Schedule your key priorities early in the day, then fill in the rest of your time with other tasks. Avoid multi-tasking and focus on one thing at a time. Add your time-blocking schedule to your agenda book, and try color coordinating different tasks, from urgent to routine.

March - Increase marketing: Schedule a time to meet with your loan officer to discuss co-branded marketing opportunities, and create a specific plan based on your business. Whether you’re new to marketing, or you’re a pro, you should always be looking around for new or different opportunities to market to new prospects. We have a team of in-house marketing professionals who can help you design a marketing campaign to increase your prospects and get new clients in the door.

April - Update your headshot: If you haven’t updated your headshot in a few years, now might be the time. You are the face of your business, so take the time to get a professional headshot and update it on your website, social media sites and listing portals. It’s a worthwhile investment in your personal brand. Why? A good headshot conveys professionalism, your personality, and makes you look and feel your best.

May - Adopt new technologies: If you haven’t already, download our co-branded mobile app. The mobile app is a digital business card and powerful tool that allows clients to calculate payment scenarios, browse for homes and apply for a mortgage all on their phone. You can add your own custom links within your version of the app, such as your social media sites, websites and listings. Plus, with real-time loan status updates, you’ll always be up-to-date on the status of your client’s loan.

June - Get social: Increase brand awareness by posting consistently on a social media site of your choice, such as Facebook, Instagram or LinkedIn. Social media takes time and effort and should be a direct reflection of your personality and brand. If you’re not sure where to start, reach out to your loan officer and see if they can schedule a Social Media Lunch and Learn from our social media experts. What platforms should you have a presence on? How often should you post? What types of content should you post? How do you create a strategy that shows your personality, while still being professional and positioning yourself as an expert in your field?

July - Expand your networking group or work on maximizing your sphere: Remember, nobody builds a business alone! Get involved in a new networking group to help pass business back and forth. Networking groups also serve as a great way to learn new ideas to improve your business or find new vendors or suppliers. You’ll get great advice and also gain some comradery from people who share your same hopes and aspirations.

August - Learn a new skill: Ask your loan officer to host a Lunch and Learn about a mortgage product that you want to learn more about. It’s always a good idea to be knowledgeable on the mortgage products available to your clients!

September - Start an anti-stress activity: Take up a relaxing activity such as yoga, gardening, or meditation. Try practicing mindfulness in the morning or before bed at night. There are several mediation apps that can customize a meditation routine that best fits your lifestyle.

October - Reach out to clients, old and new: Treat potential or past clients with a pop-by gift. Remember, don’t let them forget about you! Here are a few ways that you can get in front of your sphere and make sure that your nurturing your relationship!

- Follow up after a recent transaction.

- Deliver an annual gift.

- Provide an annual equity analysis.

- Personally thank them for a referral.

- Wish them a happy birthday/holiday.

- Ask for a testimonial and permission to use it.

- Ask for referrals/neighborhood activity.

- Reach out to your loan officer for co-branded pop-by ideas.

December - Reflect on the past: Reflect on your favorite resolutions from the year and plan to implement them in your daily, weekly, or monthly routine.